Friday was a disappointing day for Samsung. Its’ sales for the third quarter not just fell sharply by 20%, but to exacerbate the pain, operating profit was down by a staggering 60% in the same period. This is bad news for the Samsung fans and shareholders alike. To put things in perspective, Samsung still continues to be the leader in mobile phone shipments. The worry? Market share and shipments are beginning to show a decline

To be honest, most of us who follow the mobile world knew this was coming. Samsung,earlier dominating the world of smartphones, is now handcuffed between 2 segments of the market. If the pummeling from Apple wasn’t enough, especially with the launch of larger screen sizes, it was also getting a hit from low cost players like Xiaomi (Xiaomi, according to IDC, is now the 3rd largest in terms of phone shipments), right behind Samsung and Apple). To put it in perspective again, Xiaomi is just one of the many players taking potshots at Samsung. Micromax, Gionee and the likes are beginning tho beat Samsung at its’ own game.

The fault lies in Samsung’s product strategy that leaves consumers around the world confused, and this confusion cannot be settled even after an end number of debates and statistics. The confusion: 1) Is Samsung a niche or a mass market brand?

2) Which segment of the market does it belong to?

3) Where does the focus lie?

The answers to the above can go either way depending on where you would like to tilt. That is exactly the problem. Samsung has failed to walk in one direction, trying to shoot arrows everywhere instead.

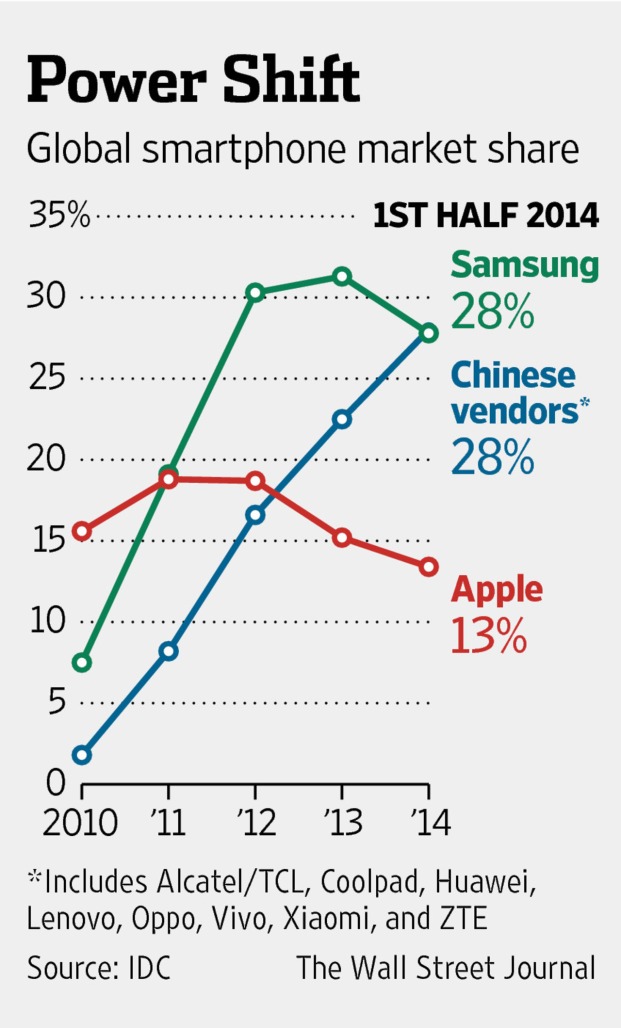

It is true that Samsung has been a leader for years now and this could be a finding in hindsight. But things were different then. Most players (Blackberry, Nokia, LG, HTC and so on) were struggling and the fight was squarely between Apple and Samsung. If you didn’t opt for Apple’s camp, Samsung was the obvious option. The charts below a timeline that demonstrate how Samsung’s market share has fared against its’ competitors in the recent years until now.

A further break up of this market share will give us enough information on why it is getting harder for Samsung to retain market share:

| Period | Samsung | Apple | Huawei | Lenovo | LG | Others |

|---|---|---|---|---|---|---|

| Q2 2014 | 24.9% | 11.7% | 6.7% | 5.2% | 4.8% | 46.7% |

| Q2 2013 | 32.2% | 13.0% | 4.3% | 4.7% | 5.1% | 40.7% |

| Q2 2012 | 32.2% | 16.6% | 4.1% | 3.1% | 3.7% | 40.2% |

| Q2 2011 | 17.0% | 18.8% | 2.5% | 0.2% | 5.7% | 55.7% |

Things have further changed in Q3, 2014 as Xiaomi emerged as the 3rd largest player, further denting Samsung’s prospects:

This shows a consistent fall in Samsung’s market share, from around 32% in 2013 to a low of around 24% in the 3rd quarter of 2014

So what has changed in the last few months. The market looks in a different shape now: Sony is

So what has changed in the last few months. The market looks in a different shape now: Sony is  turning around, Microsoft Lumia (erstwhile Nokia) is showing signs of revival ; LG is beginning to showcase the best in mobile technology Chinese power brands like Xiaomi are offering cutting edge specs at delightfully low prices, focusing on volumes to offset low margins. Some like Xiaomi are also redefining ways of business by building a cult around their brands and at many occasions, opting for ‘online only’ sales to cut down on the costs incurred as a result of ‘middlemen’.

turning around, Microsoft Lumia (erstwhile Nokia) is showing signs of revival ; LG is beginning to showcase the best in mobile technology Chinese power brands like Xiaomi are offering cutting edge specs at delightfully low prices, focusing on volumes to offset low margins. Some like Xiaomi are also redefining ways of business by building a cult around their brands and at many occasions, opting for ‘online only’ sales to cut down on the costs incurred as a result of ‘middlemen’.

This has also had an adverse effect on not just sales but operating margins too, which reflect the customer’s tendency to opt for other low cost brands or Apple as an alternative to Samsung’s Galaxy line of flagship phones. Samsung hasn’t done enough to distinguish its brand from competitors and this means consumers are either refusing to pay a premium and for those who are willing to, Apple provides for a viable alternative with its superior brand image and visibility.

Samsung has to make up its mind. It will continue to lead but at this rate, it won’t be very long before it becomes s shadow of its past. It either has to focus on the mass market or take a flight to the upper end. Also, the now notorious strategy of launching phone to attend every price point and customer is also not likely to work. It needs to focus on genuine innovation and clarify on the brand’s ultimate intentions.

Sure, this might make a temporary dent in Samsung’s fortunes in the coming 1-2 years. But with a long term focus, Samsung will have a clear direction. Also with phones like the Samsung Galaxy Note 4 and more wraparound or curved screens like the Samsung Galaxy Note Edge in the near future, there is not an iota of doubt that Samsung has the capability to make class leading phones but all it needs is focus. With enough cash and R&D at hand, Samsung should see through the tough times without hurting itself much, except for the shipments in the segments it chooses to exit for good.

If Samsung wants to retain itself in the lower and mid segments, it could as well launch a separate brand to cater to them. With Samsung’s penchant for a quick roll-out of new products and offerings across a number of price points, low cost players could be in for a ‘rude’ surprise.

Whatever might be the case, I am confident that Samsung’s ‘have it all’ strategy has its’ fair share of fundamental flaws and this strategy needs to be reversed if Samsung intends to stay relevant in the mobile space. I can hardly think of a brand that places itself in all corners of a marketplace and yet gives clear and concise signals about its brand positioning. Samsung has to decide: Whether it wants to be the Hyundai, Cherry, Volkswagen or the Mercedes of tomorrow? It cant have it all, at once.

Follow me @SauravD86 for more news and updates on the tech world!