Apple, on the 21st of this month, launched the much hyped 4 inch iPhone, dubbed as the iPhone SE. This iPhone, according to Apple isn’t just the most powerful 4 inch ever, but could also be the iPhone with the simplest presentation that Apple could offer to its customers. It should go like, ‘Take the internals of the iPhone 6s, put it in the iPhone 5S case, take away 3D touch and market it as a phone for people who prefer the compact 4 inch screens.’

Apple enters the mid-tier segment but with speed breakers on Innovation

In the real world though, Apple is positioning this as a mass market product for people in the mid-tier segment who want an Apple phone but couldn’t afford one until now. This is for customers who were either un happy with their Android/Windows devices or were in the hunt for an iPhone in the second hand market (This market is really huge by the way). These customers would most likely be 1st time Apple users who would be ready to shell out a minimal premium to enter the Apple eco-system. Barring a minor % of people who actually prefer a 4 inch phone, this is for the customer who dreams of a Mercedes but eventually settles for a Skoda. Both are my favourites for the record.

happy with their Android/Windows devices or were in the hunt for an iPhone in the second hand market (This market is really huge by the way). These customers would most likely be 1st time Apple users who would be ready to shell out a minimal premium to enter the Apple eco-system. Barring a minor % of people who actually prefer a 4 inch phone, this is for the customer who dreams of a Mercedes but eventually settles for a Skoda. Both are my favourites for the record.

The markets always looks north

Apple is a company with a $590B+ market capitalisation. It’s phenomenal rise and influence as a tech company is next to none. However, such rise and influence often comes at a cost: the expectation to ‘eternally’ grow at a scorching pace, ignoring the fundamental law of averages. Apple’s shareholders are hungry for more growth and the market will take Apple by its horns if it falters on the path of growth.

Such expectations and pressures could even make the heavens nervous. Until now, the tides were in favour of Apple and there was an invincible Halo effect that continued even under the leadership of Tim Cook, a genius in his own right. Now, as is with any Halo effect, the influence of Apple on the minds of the consumers is withering. And Apple’s decisions are a result of that.

Innovation is taking a beating at Apple.

Apple is a company that has built its reputation on innovation. It’s massive user base and respect for the brand was an end result. The tables have shifted now, as Apple is now seen juggling with cosmetic innovation to keep the juggernaut running at a steady pace. Apple, with the launch of the iPhone cover at $99, showed that the urge to keep the mills running can hasten innovation and ridicule the company’s reputation. This juice pack was dubbed as the ugliest design by reviewers and admirers of Apple. The Apple pencil and the Apple keyboard at $99 and $139 each, meant that Apple was finding additional ways to make that extra buck to keep the investors happy. the clever decision to start with a 16GB iPhone instead of a 32 GB base version also meant that customers would essentially be misled into believing that they are making a voluntary choice to upgrade to a 64 GB version by just shelling out $99 more. In India, this choice could mean shelling out an additional $130!

Apple : Time to learn some lessons from your biggest competitor : Samsung

The iPhone SE is also seen as a compulsion to keep the company growing, even if it comes at the cost of the company’s reputation as an uncompromising innovator. Apple has very wisely entered the mid-tier segment of the smartphone market where there is an opportunity for Apple to grow by stealing the Android pie from other manufacturers but this launch seemed like a company in a hurry. Everything from the presentation (which was really subdued and boring) to the design of the phone was unworthy of Apple. Apple has made minimal changes to the design of the iPhone 5s and added almost nothing to the specs of the iPhone 6s when assembling the iPhone SE. Simple features like water proofing and wireless charging functionality could have been added but Apple has chosen to reserve these features to excite investors and customers for the latter half of the year. The starting price in India has been pegged at Rs. 39,000 and makes me wonder why any smart buyer would not opt for a Samsung Galaxy S6 instead of this one. Samsung could throw in a surprise too by launching an updated S6+ to take on this segment and leave Apple jolted.

“The world needs Apple to behave like Apple. Seriously”

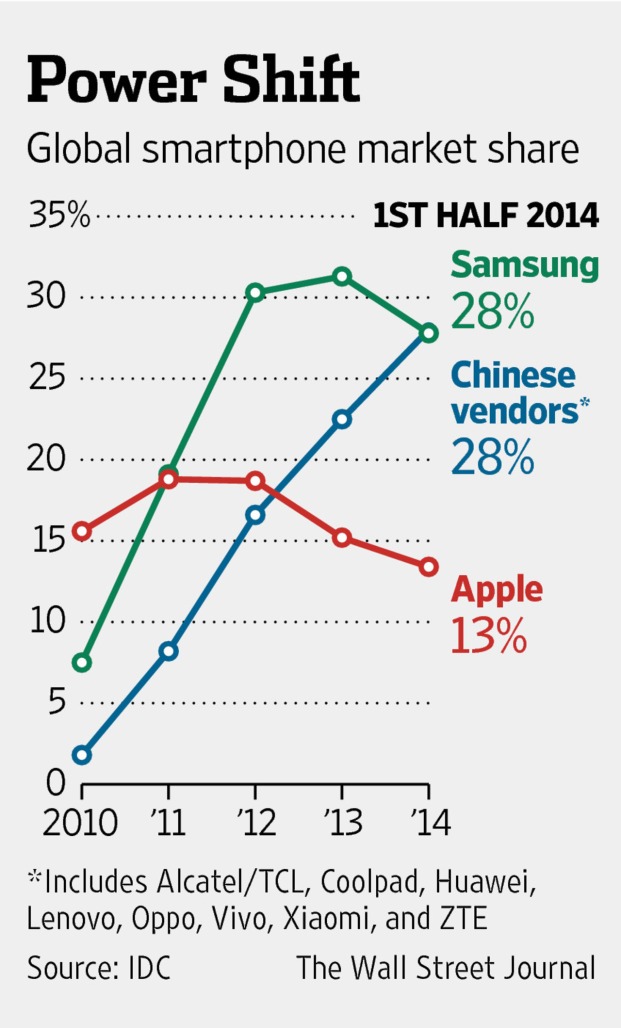

Apple is still a customer focussed company as on this date but its commitment to the cause is waning with every launch. Apple’s management should realise that growth was and will continue to be a result of real innovation and increments in the user experience. Customers take some time to digest developments in perception and shall continue to pick up any device that Apple comes out with for a few more years. However soon some competitor will eventually seize the  opportunity to trip Apple when it can. One should learn a lesson from Samsung when it was faltering in innovation and differentiation until 2014. It revisited the root causes of success in consumer tech and reshaped how customers perceive Samsung. Today, the early adopters and expert reviewers would not blink in declaring that in areas like camera and real world features, Samsung is inching ahead of Apple. As of today, Consumer Reports, a very respected name in technology has dubbed the recently launched Samsung S7 as the best phone ever.

opportunity to trip Apple when it can. One should learn a lesson from Samsung when it was faltering in innovation and differentiation until 2014. It revisited the root causes of success in consumer tech and reshaped how customers perceive Samsung. Today, the early adopters and expert reviewers would not blink in declaring that in areas like camera and real world features, Samsung is inching ahead of Apple. As of today, Consumer Reports, a very respected name in technology has dubbed the recently launched Samsung S7 as the best phone ever.

Investors cannot be blamed for Apple’s decisions. They have put in their money and will expect staggering returns for their buck. If Apple wants to continue to dominate the landscape for not just three but another two decades, it has to look at a roadmap that is sustainable, even if it means taking a pause for a fresh breath of air. A couple of years of stagnation would not then indicate that the company has been wrecked, but is ready for an another giant leap to leave us all in admiration. The world needs Apple to be like Apple. Think.